Having investment rules is critical as it is what keeps you from following the flock and making questionable investing decisions.

It’s also important to keep them simple to make sure your rules are actionable.

Why Use Investment Rules

How often do you resist buying hot stocks in the news? With some investing rules, you can avoid falling for hot tips or becoming emotional.

The rules you put together keep you grounded and make you follow a process.

I will be the first to admit that it has taken me many years to sort out my rules. While I initially started with 7 rules, I realized that I have many unwritten rules and I decided to put them all down on paper.

Rules lead to building a process and a process keeps you honest with your goals. After all, investing is critical to build wealth, you want to avoid mistakes when you can and learn from those you make.

While working on listing my investment rules, I was curious how they were compared to other investors. Am I going against the flow? Am I alone with the rule? or do I have more in common with others?

To get an idea of where my rules stand, I ran a survey with my readers. I have now compiled a lot of data from hundreds of real DIY investors like yourself to show my rules aren’t that odd- even it if goes against the financial industry’s saying … And many of the data points come from successful retirees.

Here is the survey breakdown by investing cycle: accumulation or retirement phase. The colours are the same throughout all the graphs for comparison.

Type of Investment Rules

My rules are broken down into 4 categories to simplify the usage and application of your investing strategy.

Portfolio Rules

These rules help manage your portfolio.

Business Rules

These rules deal with the companies you are looking to invest in. Filtering by metrics is important, but I believe the business is more important than the metrics.

Metrics Rules

These rules help find the needle in the haystack. For a dividend growth investor during the accumulation years or a dividend income investor in retirement, key criteria must be met to find the right dividend stocks.

Miscellaneous Rules

These rules can help you get an edge and don’t fall into the other categories.

Finally, before you go through the rules, they are outlined to build a dividend growth portfolio during the accumulation years. If you have a different strategy or are in retirement, you don’t have to use these rules, but you should still have rules to help you stay accountable.

11 Portfolio Rules

Portfolio Rule 1 – Investing Is Not A Get-Rich-Quick Scheme

Don’t expect to get rich overnight. I know it, and I accept it.

Investing is a proven method of building wealth, specifically, a proven way to put your hard-earned money to work. Greed, on the other hand, can lead to bad decisions.

Keeping your money in the bank in a so-called high-interest savings account doesn’t do anything. Instead, put it to work for you by investing.

Accept your rate of return based on your investment strategy. Index investing leads to average market returns, whereas other investing strategies can beat index investing and others might not.

Beating the index is my benchmark during the accumulation years. So, I am set up to track my portfolio performance and choose to buy stocks or an index ETF.

Homework: Write down the rate of return that would make you happy. Use the rule of 72, which tells you how many years it would take to double your money.

Portfolio Rule 2 – I Question All Financial Sayings

The financial industry likes to simplify investing and make it into a process they can apply to everyone, but every situation is different.

Their solution is often a mutual fund, and that’s not good advice. One that many learn the hard way once they ditch their mutual funds.

Take one saying that says, “You should have a fixed income or bonds, ratio matching your age,” but in this low-interest rate environment, it doesn’t work. It damages your portfolio.

When interest rates are low, I will not have bonds or buy bond ETFs.

The same goes for gold, when markets go down, the fear kicks in and investors flock to gold but why? What do you expect with a gold ETF in your portfolio? Many papers have shown gold doesn’t protect against inflation or economic downturns. The Canadian government sold nearly all of its gold reserves.

Investing in gold is not a scientific portfolio strategy. It’s an emotional decision driven by the feeling you need to do something. A great YouTube video going over gold to make you reflect.

Another one is the “4% withdrawal rule”. Does it still work? Most financial plans are put together assuming a 4% withdrawal rate.

If you are told to have bonds and fixed income with near 0% return, then you rely on your equity for growth, and the theory says to increase fixed income as you get older … I don’t see how the equity portion can keep up.

It’s unsurprising that many retirees from the survey have 0% fixed income. The sayings of the financial industry are not followed at all. Is that just by the DIY investors?

This is why I am a dividend investor. I want to avoid unknowns and control my retirement income with the dividends I receive. I follow dividend growth investing during the accumulation years and dividend income in retirement.

Homework: Identify if you have a fixed income and why you have them. Are you convinced of the reasons why you have them? What’s the percentage, and what do you want it to be? Ignore whatever you find out there; it’s all based on fear management. Decide what your number is.

Portfolio Rule 3 – Managing A Portfolio Is Like Managing A Sports Team

Just like a team manager wants the best player at each position and for each player to play a specific role, managing your portfolio is the same.

For example, some stocks like Alimentation Couche-Tard or Intact Financials are for growth, but others like BELL or Royal Bank are for stability and some growth.

You are an investor and a portfolio manager when you go DIY. Like a team manager, you need a plan and a strategy. You need to cultivate your holdings, but you also need to scout for the next best stock.

- The players are like your investments.

- The positions are like your sector and industry.

- The plays are how you fit your stocks on a performance scale (think of bond-like stocks for defence, millionaire makes for powerplay)

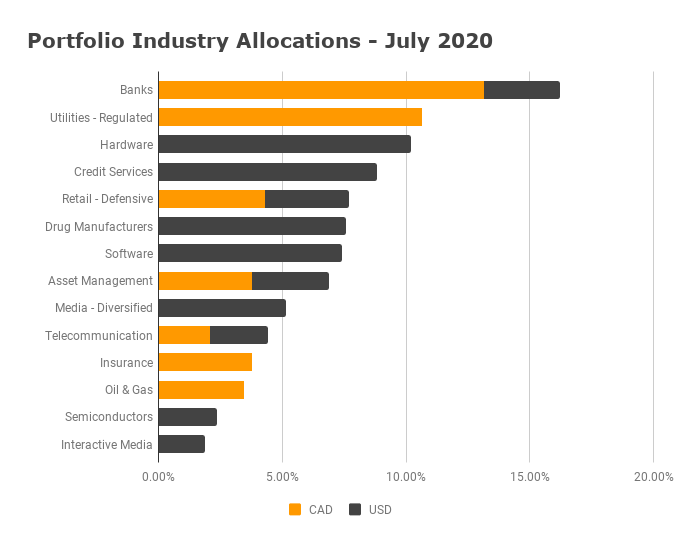

The portfolio tracker I use provides an excellent breakdown of my holdings by sector and industry, along with a holistic view of my portfolio across all accounts.

As a portfolio manager, I know that data is critical to making decisions. I have not seen a discount broker aggregate all accounts to give you one view. In many cases, when they can do it, the reports are not very useful. Do yourself a favour and think about what you need to see.

For some details, look at my monthly dividend income reports as a starting point. I can see the ratio of my portfolio against high-yield stocks vs low-yield stocks.

Homework: Get set up to have a clear view of your entire portfolio. Holdings by equity or fixed income, equity by sector and industry and total exposure to your investments (when you hold the same stock across many accounts).

Portfolio Rule 4 – I Hold Between 20 And 25 Stocks

How many players on a team do you need? It’s not an infinite amount…

The same goes for your portfolio. You need to identify a limit to work within since you can’t keep track of too many businesses.

I find ten stocks to be too little as it puts more risk on your portfolio into an equal amount of stocks. With 20, you have more room to focus on your winners and work on your upcoming recruits. You don’t need an equal weight distributed across your holdings, either.

If you have too many, you end up building an index, the You Index. If you hold all the banks and all the telecoms, it doesn’t take long, and you have many more stocks. The question is, do you need them all, or should you consolidate them?

See the graph below on the number of stocks many DIY investors have in their portfolios. Interestingly, the pattern is similar between retirees and those actively building their portfolios.

Homework: Identify the number of stocks you have. How many should you have, and why do you have them? Can you consolidate them?

Portfolio Rule 5 – No More Than 15% In One Stock

Wow, 15%. Are you nuts? I went through the 5% and 10% limits in the past 12 years, but in reality, I don’t want a hard rule here as it needs to be in the context of the economic situation.

I have a couple of winners in my portfolio where I took profits in the past as they were growing and taking profits was a mistake, so what’s the largest exposure you want? I say 15% but I watch at 10%.

The idea here is not to buy 15% worth of one stock but to allow your winners to run away if it happens. At 10% I watch but at 15%, I will consider trimming if it continues.

Index ETFs are excluded as they intrinsically invest in many stocks across sectors and industries.

After getting data from real DIY investors, you can see below what the majority think about letting their winners run. I had not expected this many investors with more than 10% in one holding, let alone this many retirees.

Homework: Get set up to track the ratio of your holdings. You want to know how much of a company you have across your accounts.

Portfolio Rule 6 – I Invest In My Winners

I suggest you learn from my mistakes, one of them was taking profits from my winners; you need to know which stocks are your winners.

A winner is found after holding them for a few years, where the performance has been consistent as opposed to a quick win over a few months.

A winner differs depending on your investing stage (accumulation or retirement). In the accumulation, it’s a stock with a 25% (for me) annual rate of return, and during retirement, I would say a yield of over 4% and a dividend growth of over 6% annually. (Hint: no REITs fit those criteria)

I mentally use these groupings:

- Winners: my consistent top performers beating the S&P500. Think of Visa, Apple and Microsoft

- Coasters: those are the banks for me. Yup, the backbone of the Canadian economy are just coasters.

- Losers: stocks that are not meeting the expectations you had set and you now have reservations. Those that you say “I hope” …

Homework: Identify your winners. It’s ok if you don’t think you have any. Flag your stocks into Winners, Coasters and Losers.

Portfolio Rule 7 – Know When To Cut Your Losers

As a team manager, you need to cut players sometimes, which is usually about fit or performance.

The same applies to your portfolio. Keeping your losers or less-performing stocks can have a lasting negative impact on your portfolio.

Buy and hold is a common saying, but it doesn’t mean you blindly hold forever. Companies will evolve and adjust, and only the best management will keep the older companies relevant. Think of IBM in this case.

The biggest warning sign in portfolio management is when you hear yourself saying the word “hope”. When that happens, you need to SERIOUSLY look into why you are holding the company and what the alternatives are.

A more process-oriented approach is to do a quarterly review of your holdings and make sure your reasons for each one of them still hold.

Homework: Make sure you write down why you invest in each of the holdings you have so you can validate any changes and have a clear understanding of selling a holding.

Portfolio Rule 8 – Don’t Ignore The US Market

The Canadian stock market is small compared to the US and other countries. It’s also indexed toward financials, energy and basic materials sectors, limiting your options to find winners and reduce your risk.

The currency exchange is usually the first hurdle to overcome, but do note that you don’t need US dollars to invest in the US. You can buy a Canadian ETF that covers the US stock market. You can buy the S&P 500 index or the Nasdaq 100 index very easily.

Historical data could prove performance was good in Canada 40 years ago, but that’s like a lifetime in the investing world.

I don’t want to ignore history, but I also want to put it into context. In the 80’s, Canada’s oil was ruling … is it ruling today?

As a rule, it appears to be shared amongst many from the data below. There is no need to stress picking a US stock either, as you can buy the S&P 500 Index ETF in Canadian dollars (VFV ETF).

Homework: No homework. Just think about it; it could benefit your portfolio. The majority of my profits are from my US stock investments.

Portfolio Rule 9 – Scout & Monitor

Scouting is critical so you can find the next winner. It took me 12 years to reach the point where I am very satisfied with my portfolio.

Still, I continue to scout for my next winners to this day. Once I find a company with potential, I put it on my watch list and monitor it for a while.

The idea of monitoring is to identify if the company meets your business rules (more on that later).

Homework: Build your watchlist. Google Sheets is great for that but you can also use Yahoo Finance on your mobile phone, that’s the one I use.

Portfolio Rule 10 – Diversify Across Industries, Not Sectors

You will hear that you should diversify across sectors and that’s what I focused on back in 2009 but you should diversify across industries.

There are 12 sectors as opposed to hundreds of industries. However, many companies under the same sector in different industries have little overlap.

Take credit card companies like Visa and MasterCard versus the banks like TD Bank or Royal Bank. All of the companies are in the financial sector but they have little overlap. The same applies to a property insurance company like Intact Financials.

My Own Advisor has a similar rule – Through diversification, you can improve performance with less investment risk. If you are unsure about how to obtain diversification via individual stocks, then consider index investing. The concept of exposing your portfolio to all sectors is flawed.

Homework: For each of your holdings, list the industry it is classified under. Specifically, when you look at data providers, it’s often referred to as the sub-industry.

Portfolio Rule 11 – Be Tax Efficient

Being tax efficient doesn’t mean avoiding paying taxes and leaving money on the table. It means being smart and aware of the taxes you would have to pay.

- Understand the difference between dividends and distributions, for example.

- Know the implication of US dividends withholding tax for the various accounts.

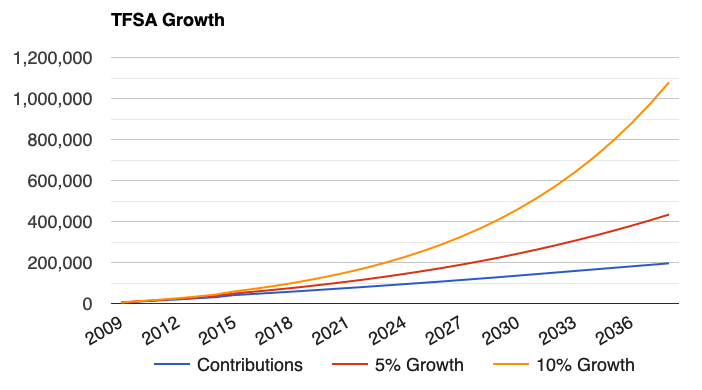

- Maximize the tax-free accounts available.

I am not going to outline a blind rule where it says to invest your US dividend stocks only in an RRSP since I have US dividend stocks in my TFSA and non-registered. Those stocks have a low dividend yield (1% or under), and the tax withholding is minimal compared with the total return.

Taxes vs total return is a balance.

GenYMoney has a similar rule – If you have high-yield US dividends, it is best to put them in your RRSP.

Homework: For each of your holdings in each account, identify if it’s tax efficient.

7 Business Rules

Business Rule 1 – Understand the Businesses

You need to understand how the company makes money. This is a must in my opinion.

Imagine you have two friends asking you to invest in their business, which is what the stock market is by the way, one friend says he wants to start a food truck business and the other is opening a pizza place. Both are asking for $25,000. What questions do you ask?

Whatever questions come to mind is probably about the business plan like location, customer potential, and some financial questions.

In a way, investing in a publicly traded company is similar. You need to capture the essence of the business and revenue potential, along with the potential risk for the business.

I like subscription and tollbooth businesses with a large economic moat. A regular pay from customer is much easier to manage than a discretionary spend.

Homework: Write down what you know about the business of your investments and list all the revenue sources.

Business Rule 2 – Invest in Toll Booth Businesses

Companies that can easily grow their revenue consistently have their hooks in with their customers and have them pay ongoing fees that are predictable.

These businesses often provide a “business” necessity that must be leveraged by other businesses such as cloud computing or electricity to keep it simple. When it comes to electricity, it’s regulated since it’s considered a necessity in society.

Another word for toll booths these days is subscription business. It’s a lot more predictable to pay $10 per month for music than to estimate the number of albums you can sell. It’s much easier to increase your streaming service prices when your costs go up and you want to maintain your profit ratio.

Coca-Cola, for example, is not a toll booth business. It has to make products and market products over and over.

Homework: For each of your holdings, write down if the business is a toll booth or not.

Business Rule 3 – Invest In Global Companies

The ability to operate globally opens a lot of doors for higher revenue. Look at the Canadian banks; they all expanded globally with various successes.

For a Canadian company, making it in the US is a big deal; going global is another big deal.

Homework: Identify if your holdings are global or local to the country.

Business Rule 4 – Look For Market Leaders

Usually, the companies leading the markets will have a competitive advantage. Either through negotiation power, purchase power, distribution channels, brand or some other capabilities.

Being a market leader requires strategic planning and execution as the competition is always there to take your customers. Ask yourself if someone can easily do the same thing and take market shares away.

Bob from Tawcan has a similar rule – Invest in companies that people complain about their pricing but can’t switch.

Homework: For each holding, identify what makes the company a market leader

Business Rule 5 – How Pervasive To Our Daily Live Is The Business

You need to look at it from a consumer perspective but also from a business perspective.

Take the airline industry; 50% of their revenue is from business travel. As for utilities, everyone needs them which is why it’s regulated but when you look at the railway, it’s moving products that everyone needs.

Ultimately, how will not having that business impact living from day to day?

Homework: Identify if the company is in the necessity business.

Business Rule 6 – Identify the Stage of the Business Life Cycle

A company growing is not the same as a company that has matured.

Companies go through a business life cycle where they start small, grow and mature. At each stage, the company has to decide how to reinvest the profit.

Here are the business life cycles that resonate with me. No need to be academic here, but it’s a reason to avoid penny stocks and the gamble.

- Start-up: A new launching new products or services. Rarely do they trade on the stock market. Still proving themselves ahead of an IPO.

- Growth: Successful launch and growing. Usually with rapid sales growth. Looking at an IPO and turning a profit.

- Established: Sales are slowing down from competition or saturation.

- Maturity: Sales are normalizing, and profit margins are getting thinner.

- Expension/Decline: This is an adapt, or fail turning point. Larger companies will have products go through the cycle internally at faster rate.

Oftentimes, dividends are paid when the company has extra cash and doesn’t see a way to re-invest it in the business.

Homework: Identify the stage of the business life cycle each of your holdings is in.

Business Rule 7 – Is the Business Recession Proof?

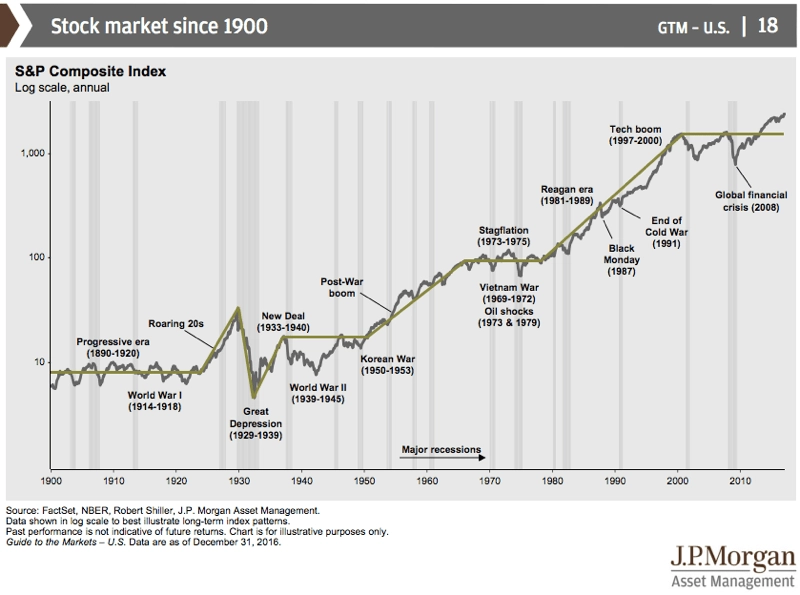

Recessions are theoretically cyclical and happen every seven years, as a rule of thumb. This is why I like to examine ten years of historical data.

Look at the price charts and assess the company’s recovery during a recession. Let’s be clear that not many stocks don’t go down during a recession. The sheer panic selling brings all stocks down, the question is how long does it take for the recovery?

Make sure it follows the index, at least.

Homework: Review the performance history to assess how the company did during a negative market. Did it bounce back or not?

7 Metric Rules

Metrics Rule 1 – 10 Years of Consecutive Dividend Growth

Ten years of consecutive dividend increases is critical for me – some exceptions could be made.

Fifty years of dividend increases is irrelevant as it can lead to 1 cent or a fraction of a cent to keep the streak alive. So, Dividend Kings are not important. The Dividend Achievers are the most important.

Now, banks have been told not to increase recently during the pandemic, so you can make a judgment call and make an exception.

Mike from The Dividend Guy Blog has a similar rule – Throughout the years, most of my best stock picks have been among the strongest dividend growers. Those companies must earn increasing cash flows and show several growth vectors to be confident enough to offer a 5%+ dividend increase year after year.

Homework: Write down the number of consecutive years of dividend growth your holdings have.

Metrics Rule 2 – A Chowder Score of 10% or more

The Chowder Score tells a great story about the company’s track record. The twist I put on the Chowder Score eliminates outliers.

Take a moment to read the Chowder Score to understand it, and then pick your number. I start with 10%, but a 12% or 14% is good too.

As a side note, it’s not a free metric you will find, and the dividend growth is also not free. This metric, which I consider critical, is a pivotal moment when you decide to access paid data. Dividend Snapshot Screeners gives you access to my formula and Stock Rover (14-day free trial) gives you access to the default formula.

Homework: Write down the Chowder Score for each holding.

Metrics Rule 3 – Avoid High Dividend Yield

A high dividend yield indicates a challenging situation. You might be able to ride it out for a while, but it suggests investors will vote against the company.

The other concern is that high dividend yields are not sustainable for dividend growth. You can’t have a win-win situation with dividend yield and dividend growth as they have an inverse relationship in normal times.

Avoid stocks with a dividend yield above 5%; it is a big warning sign.

With that said, the graph below outlines the desired yield by DIY investors who took the survey. A total of 21% seek over 5%.

Homework: Write down the yield for each of your holdings.

Metrics Rule 4 – Watch For P/E Outliers

I don’t like to say look for a P/E of 12 or under 20 or any other number …

The reason is that not all industries are similar for growth and not all companies are at the same level of their business maturity. Even when the company is in the same industry or sector.

The key here is to compare the P/E with the peers within the same industry and business maturity. What’s the average? Where is your holding in comparison?

Don’t use sectors, as it’s too broad. Disney and Facebook are in the communication services sector now, for example, and so is Netflix, but their businesses are different.

Homework: Write down the average PE of the industry peers to compare your holdings against.

Metrics Rule 5 – Watch For Payout Ratio Outliers

The payout ratio needs to be used in relation to the business maturity and the type of cash flow the business generates.

You also need to compare companies within the same industry and within the same business cycle.

I don’t have hard rules on numbers, as you can’t put all the companies in the same bucket with one simple rule.

Homework: Write down the average Payout Ratio of the industry peers to compare your holdings against.

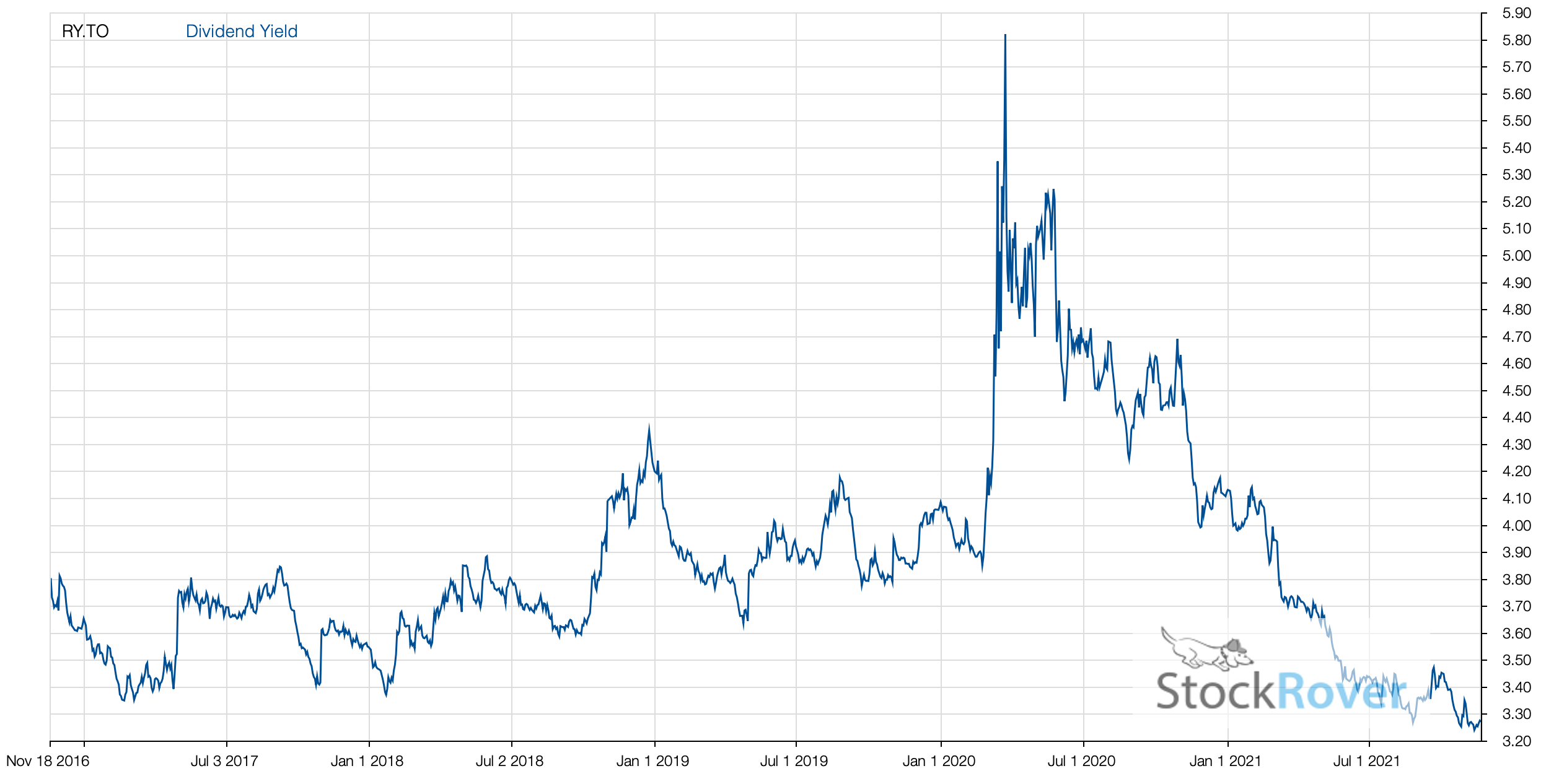

Metrics Rule 6 – Review Yield Against Historical Yield

When a business grows its earnings, the stock price tends to grow and when it also grows its dividends, the yield tends to stay flat.

If the yield goes above historical norms, assuming all other factors are good, it can be a buying opportunity (i.e. undervalued).

If the yield is below historical norms, then the stock can be considered overpriced.

I never had access to this data, and the only service I know offering historical yield at a decent price is Stock Rover.

Homework: Is the yield above or below the historical trend?

Metrics Rule 7 – Must Keep Up with S&P500

The S&P 500 is my benchmark. I have used it for years.

Why not the TSX 60? It’s not very diversified, and my core Canadian stocks are already in the TSX 60. The TSX 60 is much better than the TSX in general. The XIU ETF is used below to represent the TSX 60.

Homework: Is the company’s performance on par or better than the S&P500? At the least, it should beat the TSX 60.

6 Miscellaneous Rules

Miscellaneous Rule 1 – I Can Handle Market Volatility

Now that we have established rules that point you towards equity investing, you need to know what you are made of.

If you can’t go through an economic downturn as we had in 2020 or 2008 without panicking, you have to accept that your portfolio will not grow as fast since the solution to avoid a panic is to increase your fixed income, which, therefore, reduces your rate of return.

Today, investing has no win-win situations where your money is safe and grows. The high interest rates of the 80’s are gone.

I elected to be 100% in equity, and I know many retirees with a portfolio exposed to 100% equity.

Miscellaneous Rule 2 – I Don’t Follow Value Investing

I don’t buy the argument that your profit is made when you buy.

Value investing is challenged by companies that still have growth as you can’t apply the same metrics and filters, and it becomes complicated quickly.

Remember the business cycle from a previous rule; the value is different at each stage. The Graham Number, for example, ignores the business cycle and can’t be used the same across companies.

Waiting for a price to buy means you can miss out on the growth for years when all business rules have been met.

In short, focusing on value means focusing on very mature businesses with limited growth, which means your higher return is made when you buy.

Miscellaneous Rule 3 – 52-Week High Is Not a Problem

I prefer a stock that hits a 52-week high rather than a 52-week low. (Under normal circumstances)

Yes, it’s counterintuitive, but here is why. Under normal circumstances, a 52-week low means the company is struggling or pivoting. It cannot be a market leader, or the business cycle is very mature, and growth is limited.

A company that makes a new 52-week high has ongoing potential for growth, and waiting for a drop might mean you keep on waiting for a long time, and you may miss out completely.

Miscellaneous Rule 3 – No REITs For Me

Real estate investing is easy to understand. You buy a property, you rent it, and you make money each month. It requires significant capital and you have to deal with tenants so it’s not for everyone.

Income investors like REITs for the higher yield, but they don’t match my investment criteria. Therefore, REITs are not part of my portfolio.

On the other side of the coin, REITs are companies in the real estate business and not rental properties. Just like Bond ETFs are equities holding fixed-income assets.

They tend to pay a high yield, which breaks one of my rules, but they don’t have distribution growth. The distribution growth barely keeps up with inflation.

See the breakdown below for many DIY investors on their exposure to REITs. At least 1 DIY investor focused only on REITs. There are no specific patterns between the retirement and accumulation phases.

Miscellaneous Rule 4 – I Hold US Stocks in Any Accounts

Another counter-intuitive rule from what you will read.

I won’t blindly hold any US stocks in all accounts but I consider the total return of the holding before I consider the tax consequence of the dividend withholding tax.

My mental rule is that if the US stock has a dividend yield under 2%, I will invest it anywhere, but if it’s over, I will work on having it in my RRSP first.

Miscellaneous Rule 5 – I Hold ETFs in my TFSA or RRSP

This rule is to simplify my accounting. I don’t want to deal with all the tracking for ROC (return of capital) in my taxable account.

Miscellaneous Rule 6 – Avoid Complicated Share Structure

As some of you may know, I sold all of my Brookefield holdings in late 2020.

I just got tired of the complicated share structure. They created multiple entities out of BAM.A, and then they create more entities out of BIP.UN and BEP.UN. Great management, but I lost the ability to follow and make sense of it all.