After many years of dividend investing, and over $273,593 in dividends earned over the years, I have grown as an investor and I have had my share of investing mistakes to share along the way.

I would argue that it is practically impossible to start investing early and have all of the knowledge at hand, but investing is of critical importance for financial freedom. My children, for example, are already investors through Questrade (as adults) and Computershare (at an early age). They are starting to learn the ropes early on but still lack a lot of the necessary skills to select a stock or manage a portfolio.

I have had many discussions with them and failed to teach investing regularly, even with many investing lessons to share. I won’t give up and will continue to find ways to simplify compound growth and explain risk management or emotional fear from risk.

I am trying to make the point that all investors need to learn the ropes and get better with experience. The journey differs for everyone, but we are all investing in the same stock market and playing by the same rules. Regardless of where you are at, investing is still the best way to build wealth.

In the 4th learning from my investing lessons, I share my dividend earnings since I started tracking my dividend and performance back in 2010.

Some of the investing lessons may be obvious to a seasoned investor but we all have to start somewhere… In the spirit of helping others avoid the same mistakes, here are 6 learnings.

These were what I learned throughout my journey, and they have helped me define my investing rules.

6 Investing Mistakes, or Beginner Investing Mistakes

The faster you learn, the richer you will be!

Investing Mistake #1 – High Yield Stocks Are Risky Bets

High-yield dividend stocks will not generate wealth in the long run. You can use a high-yield stock as a proxy for interest rates for income, but you risk losing in the end.

Why? Businesses need to generate revenue to cover expenses and then use the profit to grow the business or return the money to shareholders. The yield is a function of the price, and for a yield to go up, 1 of 2 things must happen;

- The stock price drops, which is not usually a good thing as it signals trouble.

- The dividend goes up, which means less money to re-invest in the business.

Outside of REITs, rarely will a high-yield stock maintain the dividend yield through all economic cycles. It means you have to pay attention to your holdings and their business very closely. It’s not always a “buy and hold” situation like other dividend blue chip stocks.

I was a little naive back in 2009 when I started dividend investing and realized that high-yield stocks were not helping me grow my wealth. Sure, I was getting a yield better than bonds or GICs but that was it. I was missing the growth part of a strong company.

There are a couple of ways to look at high-yield stocks.

- The first is to simply look at any stocks paying more than 6%.

- The second is to look at the yield against the sector.

I categorize yield this way from a Canadian perspective.

- Over 6% is a risky yield (unless there is a market crash) or it comes from advanced investing instruments (think covered calls)

- Between 4% and 6% is high yield (company has consistent excess cash)

- Between 2% and 4% is normal yield

- Under 2% is low yield with higher stock growth

This mistake was one of the biggest investment mistakes I have made. Why? It prevented my portfolio from growing at a faster rate. When you are 30 years away from retirement, don’t invest like a retiree. It’s the difference between working 10 more years or retiring early at your leisure.

Investing Rule: Set a dividend yield range for each industry that you find acceptable and stick to it.

Investing Mistake #2 – Research by Sector or Industry

Compare apples with apples and oranges with oranges. Comparing the dividend payout ratio of an energy stock with a technology stock will usually lead to the same conclusion. The dividend payout ratio from the energy stock will be high and the technology stock will be lower. It’s simply the nature of their business.

Learn how sectors operate to compare the right metrics. In the financial world, analysts, who review companies, stick to a sector or even an industry. There is an amazing breakdown of the sectors and industries on Wikipedia called Global Industry Classification Standard. You will find a large table breaking down the 4 groups below.

- 11 Sectors

- 24 Industry Groups

- 68 Industries

- 157 Sub-Industries

Investing Rule: Compare your stock selection to the other players in the sector and industry before making the trade.

Investing Mistake #3 – Write Down Your Strategy

You will be inundated with the best of X stocks or now is the time to buy X or any other media comments that will cause you to review your holdings. Writing down your strategy means that you will focus on it and ensure your holdings match your strategy and leave your emotions at the door.

Check out these investment rules that provide a compass for my portfolio to get you started.

You can adjust your strategy as you learn more but don’t make emotional trades. If you are a dividend investor, will you ever hold non-dividend stocks? If so, what’s the percentage? Write it down and be accountable.

Here are some questions to help you define your strategy and your investing rules.

- What is your stock selection strategy? Growth? Income? Blended?

- What metrics matter to you? I see some relying on debt balance while others focus on yield or even the P/E. Oftentimes, they are proxies for valuation when including a historical comparison.

- What is your sell trigger?

- What is your sector diversification strategy? Or country diversification approach? Or income vs growth?

Investment Rule: Write your investing strategy and rules down. Make it a check and use it when making trades or reviewing your portfolio. Have a quarterly review to decide on bigger changes.

Investing Mistake #4 – Dividend Growth Compounds Fast

I stumbled upon two concepts some years ago that have helped me focus on dividend growth even if the dividend yield is below 2%.

Concept #1 – An investment firm interview on Business News Network said they only looked to hold dividend stocks with a 10% dividend growth rate over 10 years. The concept had me intrigued and I started assessing which stocks would fit the criteria and liked the concept.

Concept #2 – I read about the Chowder Rule, and the concept resonated with me and my strategy. I found the relationship between dividend growth and dividend yield to be a great indicator when all other variables are within acceptable range. The Chowder Score for estimating total returns is the easiest way to approximate your return. No need for some fancy formula with multiple hypotheses.

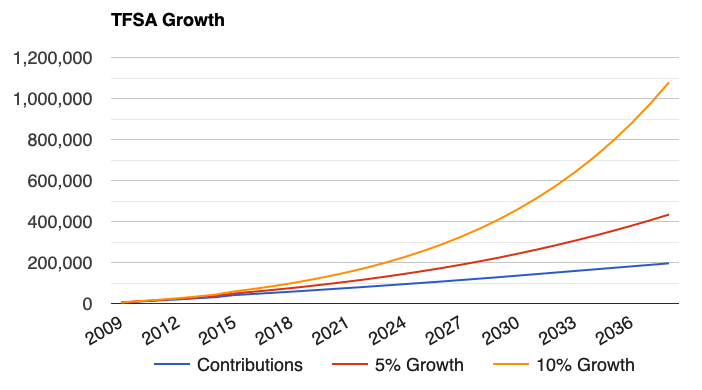

See below what compound growth has done for my portfolio in the last few years. Early on, I had some high dividend yield stocks, and as I learned about dividend growth and total returns, I started shifting my portfolio and saw the compound growth in action.

I also focused on 10 years of dividend growth as a minimum criterion to assess the company’s desire to grow dividends.

Investing Rule: Does dividend growth matter to you, and if so, what rate do you find acceptable?

Investing Mistake #5 – Be Scrupulous About Tracking Your Portfolio

If you want to learn from your mistakes and understand where you are going, you will need a compass. I have always tracked my finances. From the early days with Quicken tracking all expenses on my PC to now tracking only my investment portfolio using GoogleSheet as a portfolio and dividend tracker.

There are a few tracking characteristics that have grown in importance over the years.

Characteristic #1 – The dividend income earned is a way to know I am progressing toward the ultimate goal of covering my expenses with my dividend income.

Characteristic #2 – A diversification meter to understand my company exposure across multiple stocks to my diversification across sectors and industries.

Characteristic #3 – A proper performance metric. I still don’t trust the calculation from my discount broker and prefer to rely on the XIRR Excel formula and my account contribution timeline.

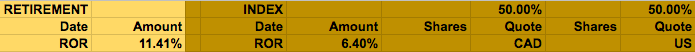

I can easily aggregate the accounts I want to see together or separate them. As a bonus, with Google Sheets, I can easily compare it to any indexes. What I love about Google Sheets is that I can use historical prices to simulate purchasing shares from an index and compare the ROR against my portfolio.

If you know your annual rate of return, you’ll be able to forecast your growth.

Investing Rule: Religiously track your investment transaction and stock details with graphs for ratios. If you don’t know, how are you able to make effective decisions?

Investing Mistake #6 – Don’t Sell Your Winners

Your winning stocks are winners for a reason. If the fundamentals aren’t changed, don’t sell your winners to add to losers.

I took profit in my winners during the drop in March 2020, thinking I could add some money to other holdings. It turns out my winners bounced back and made new highs in the summer of 2020, and they continue to make new highs.

How do you determine a winner? I go by the rate of return after holding them for at least a couple of years. For me, anything above +20% in the annual rate of return is a winner. It’s most of my US holdings if you are curious (just check my portfolio).

Your goal is to have many winners and not just 1 or 2. My Canadian winners are currently Alimentation Couche-Tard and Intact Financial. Not the usual Canadian holdings. My banks and utilities are ok and are safe holdings.

In short, while I did not lose money during the pandemic, I could have done better if I had not taken profit from my winners.

Investing Rule: We don’t find that many winners; you’ll have only a few. When you have them, let them run. It’s not about locking profits … It’s about having your money working for you, and your winners do that.

TFSA Mistakes Have HUGE Impacts

The TFSA account is relatively new but it’s turning out to be one of the most important accounts. While I have not made any TFSA mistakes, I suggest you get familiar with many of the TFSA pitfalls others have experienced.

This tax-free savings account can supercharge your retirement income tax-free. It’s easy to bring your TFSA to 1 million dollars so you need to take this account seriously.

The Complicated RRSP Account

The RRSP account has been around forever, but it’s also somewhat complicated compared with the TFSA. Just like the TFSA, there are mistakes you can avoid with the RRSP account, be sure to get familiar with these potential mistakes.

Using the tax return to go on vacation is one of the worst mistakes, as an example, and that’s just the beginning of the RRSP nuances you need to understand.