When it comes to investing money for the first time, many people are daunted by the prospect of what is likely to be a significant financial commitment. Investing can seem like an inaccessible and complicated task.

However, putting your money into safe and profitable investments is a great way to grow your savings compared to leaving them in a standard bank account.

Depending on how much risk you’re willing to take, there are several options available that won’t cost you a fortune and also offer the potential for rewards down the road. Here are some essential tips on how you can invest for your first time with confidence.

Investing Tip #1 – Pick Your Initial Expected Return

There are many ways to invest your money that won’t break the bank. As your first investment will probably be smaller than subsequent investments, you need to think about what kind of returns you want from your initial investment.

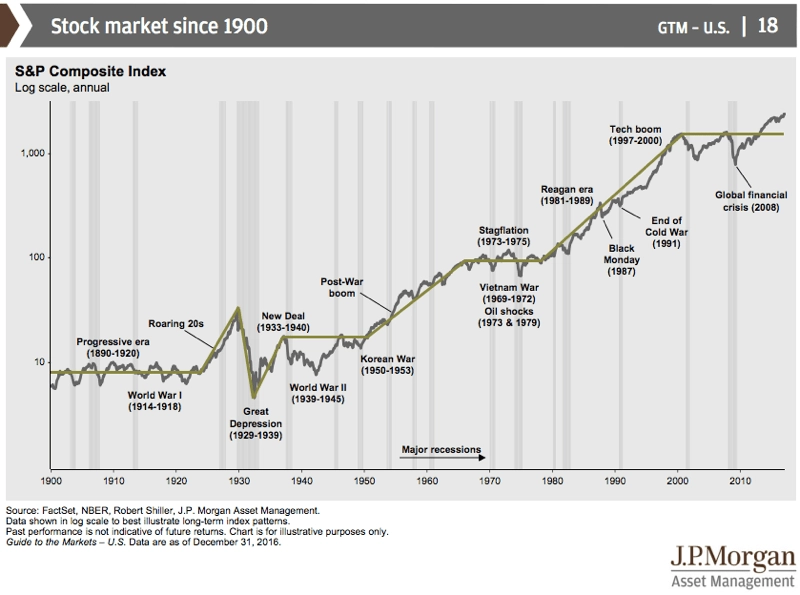

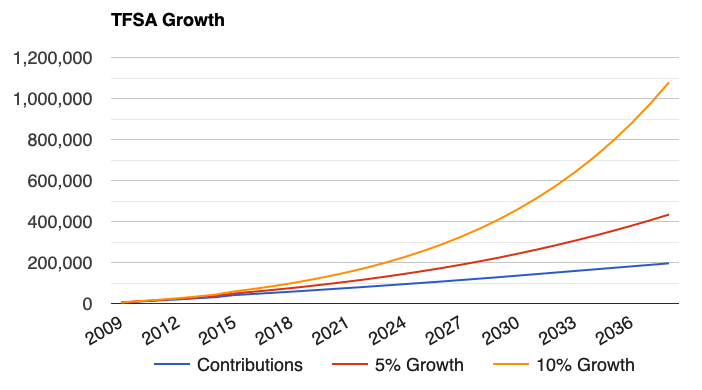

By expected return, think of the annual rate of return you would like to have over many many years. So 100% isn’t a good number. The stock market in general has returned on average 8%.

Investing Tip #2 – Be Clear On How Much You Can Invest

One of the first things you’ll need to do is decide how much you are able to invest. This will depend on a number of factors, including how much you currently have in savings, how much you make, and how much money you have coming in every month.

You will want to start small and then increase your amounts over time as you become more familiar with investing. It can be stressful initially as you navigate investing to see your investment fluctuate.

At some point, you need to make sure you have enough money to make a significant impact on your overall investment portfolio and total return towards financial independence.

Don’t forget to properly budget as you don’t want to be in a position where you need to sell your investments at the wrong time.

Investing Tip #3 – Avoid Mutual Funds

A mutual fund is an investment vehicle that pools money from several investors to purchase a variety of stocks, bonds, and other forms of assets. It is similar to exchange-traded funds but it usually has a higher cost for management and a very expensive withdrawal cost that you want to avoid.

In today’s investing environment, ETFs (or exchange-traded funds) are much better options than mutual funds and have grown significantly.

While mutual funds usually have no upfront cost and offer fractional shares to put your full money at work, there are many trading platforms now that offer free ETF trades.

Investing Tip #4 – Avoid Bonds And Fixed Income When Starting

Bonds are a type of debt that a government or corporation will issue to raise money. You can invest in a range of bonds depending on the risk level you’re willing to take. When you buy a bond, you’re lending money to the government or corporation who issued the bond. In return, they pay you interest on your loan.

If the company or government goes bankrupt, you’ll likely lose all or part of your initial bond investment. However, bonds are less risky than stocks in terms of generating high returns.

While safer, your return will likely not keep up with inflation. The best way to think about your return is to use the Rule of 72 where you divide 72 by the return and it shows how long it will take for your money to double.

Investing Tip #5 – Delay Jumping Into Stocks

Stocks are one of the most common types of investments preferred by both new and experienced investors due to the relatively low barrier to entry.

To invest in stocks, you purchase shares of a company through a trading platform and hold these shares until you decide to sell them. Not all online trading platform are the same though, and fees or features can differ and Questrade is the best platform to get started.

Questrade offers the cheapest trades!

The best broker for small accounts and new investors.

Quickly create your account online and get started with $50 in Free Trades.

The return on your investment (ROI) will largely depend on the success of the company whose stock you’re holding. Stocks are generally considered high-risk due to the fact that you can lose money if the company whose stock you buy doesn’t perform as expected.

However, stocks are also one of the most profitable investments available to investors. If you’re willing to take on some calculated risks, investing in stocks can be a great way to grow your wealth.

Investing Tip #6 – Start With ETFs

An exchange-traded fund (ETF) is similar to a mutual fund as outlined above in that it draws in money from investors and directs that capital into all sorts of investments that match the fund’s investment objective.

However, ETFs are also traded on a stock exchange similar to a company’s stock.

While mutual funds are generally managed by a team of fund managers, ETFs are often managed by a computer program that automatically buys and sells investments based on a set algorithm.

This makes ETFs ideal for investors who want to make automatic, consistent investments in a variety of assets without having to spend a lot of time monitoring them.

An ETF is a great way to invest a large amount of money because it allows you to diversify your holdings across a wide range of assets.

If you were to buy one of the best S&P500 ETFs and regularly buy into it monthly through a discount broker like Questrade, you can achieve results in the 10% growth range.

Investing Tip #7 – Avoid Borrowing When Starting To Invest

While borrowing can be a multiplier when well executed, it is a risk that you don’t want to take on when you start as it can be damaging initially. Build a strong and stable foundation with ETFs first.

More specifically, when the market drops significantly, like we had in 2009, 2020, and recently in 2022, it can be tempting and make you want to borrow to profit from the down markets.

Some investors slowdown paying their mortgage and invest the difference while others refinance their home to access the equity and invest.

Refinancing your mortgage is like a joint loan from a family finance perspective but can add burden if not properly thought out.

Once you have gotten the basics of investing, you could consider borrowing to invest but be sure to have a solid foundation and not take unnecessary risks with borrowed money.

Conclusion

Investing is one of the best ways to grow your savings and make your money grow. It also gives you a sense of financial freedom and control over your financial future.

However, when it comes to investing for the first time, you need to make sure you have a plan in place to minimize your risk and maximize your chances of success.

Stocks, bonds, mutual funds, and ETFs all have their place in an investment portfolio. Depending on your current financial situation, it’s up to you to decide which investments are right for you. Learn from the mistakes others have made when you can.