One of the most challenging aspects of starting with dividend investing may be to not know how much money we need to get started. I started investing in mutual funds back in my 20’s and I was focused on growing my RRSP (Registered Retirement Savings Plan) and maximizing my contributions. That’s what you were supposed to do … mutual funds were a mistake.

Well, the reality is that the benefits of RRSP when your income is low is not all that great from a tax saving perspective. It’s great that you start early since you will leverage the years of growth but wouldn’t it be nice to also get the benefits of compound growth with dividends? Let’s cover the options when you are young to put dividend investing in perspective.

Dividend Investing With Little Money Options

You just got your first job and you want to save some money or build a nest egg for early retirement. Chances are that you don’t have thousands of dollars available for investing. Between paying for the rent, food, and transportation, you’ll probably have a few hundreds of dollars available per month to possibly invest. With such small amounts, the options are usually the following:

- High-Interest Savings Account – Not really a growth account but at least you are putting your money aside and not spending it. The current interest rates don’t even keep up with inflation but a high-interest savings account is still useful to park money.

- Guaranteed Investment Certificate (a.k.a. GIC) – The banks will often offer GIC when you have a small amount of money to invest outside a registered account. It pays more than a high-interest savings account but it locks your money for a certain period. Interest is paid and is therefore treated as regular income if done in a non-registered account.

- Mutual Funds – Any accounts will let you invest in mutual funds (hopefully not high fee mutual funds). You can do it form your TFSA, RRSP, Non-Registered or even through the bank. Mutual funds allow you to invest very small amount at any kind of interval you want. It tracks fractional shares and it makes it very easy for anyone to invest in. I started with mutual funds but I am mostly in stocks now. If investing in mutual funds is appealing to you, I suggest you read about index investing. Canadian Couch Potato has a great site for index investors. These options tend to be what most of us are aware of when we are young. I wish I knew what I know know, as I know stock investing is well within reach when you are young. I thought it was too expensive but that was a myth.

- Exchange Traded Funds (ETFs) – It’s similar to mutual funds but you do need a discount broker account as it trades like a stock. There are discount brokers offering free ETFs transactions, do your research and settle on the appropriate discount broker. You can find ETFs that pay monthly income but most indexes also pay dividends since they hold dividend stocks.

- Stocks – Is it too expensive when investing small amounts? It’s not that bad with Questrade to be honest.

Mythical Cost of Stock Investing

Stock Investing usually requires a discount broker account. I say usually because I’ll show you how you can invest in stocks without it.

Discount Broker – Transaction Fees

The standard way of buying stocks is through a broker, and if you are like me, you are using a discount broker. The cost of investing with a discount broker can vary but I’ll highlight some of the costs depending on your broker.

- Trading Fees – It can range from $4.95 to $29,99. Questrade is by far the cheapest discount broker in Canada.

- Account Fees – Some account will have a fee depending on your capital invested and who the broker is.

Before I saw the light and did my research, I thought I’d have to pay $29.99 to trade stocks and that’s a bit steep when you only invest under $1,000.00 dollars. It can add to the share price over time. Assume you have $500 to invest every few months and you want to buy a bank. For simple math, assume they trade at $50 per share. Your 500$ only allow you to buy 9 shares. We’ll raise your capital to cover the transaction fees to buy a total of 10 shares.

- With a $29,99 fee, you would add $3.00 per share. That’s adding over 5% to your cost.

- With a $4.95 fee, you would add $0.50 per share. That’s adding 1% to your cost. Not much but it’s the cost of a low mutual fund MER (Management Expense Ratio).

Add to this any account fees for the year if you have any due to low investment capital and it starts adding up. The power of dividend investing is the ability to DRIP shares and that’s very difficult to do with a discount broker account and little money as you need to purchase enough share to generate a dividend payment that is above the cost of one share. Usually, that’s well in the thousands of dollars.

Transfer Agents – No Transaction Fees

I saw the light after reading Derek Foster’s The Lazy Investor. Through his book, I discovered Computershare and Canadian Stock Transfer. They are transfer agents for corporation allowing you to buy shares directly and at no fees. So far, all Canadian companies I have purchased do not have fees but I believe some US corporations have fees (I have not purchased any US companies through transfer agents yet). As the book title says, you can start with only $50.00. The transfer agents allow you to purchase fractional shares and most companies available also pay dividends which makes it perfect for dividend investors. The initial setup could be expensive as you need a share certificate but I found a way to get a share certificate for the price of 10$ only. It beats the cost of any discount brokers! Requesting a share certificate from a discount broker requires you to buy a share plus pay for the certificate. You could end up paying 2 or 3 times the price of the share just to get set up. The cheaper way of doing it is having someone transfer a share in your name.

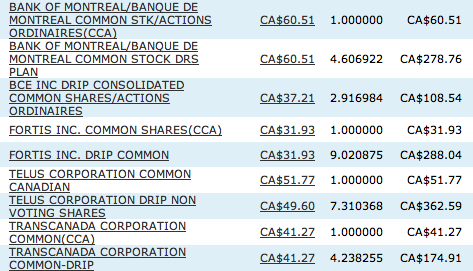

That’s where the DRIP investing resource comes into play. I bought all my first share of my 11 holdings with Computershare and Canadian Stock Transfer through other dividend investors I found on the forums. For just 10$, as a thank you for doing the work, I got set up with all these amazing dividend friendly companies. I can DRIP and let my money work for me. Just to show you how small you can invest, I’ll show you my holdings with Computershare. My total account value with Computershare is just slightly above $7,000. As you can see, you can invest in solid Canadian dividend paying companies with little money. In fact, most of my contributions over the past year have been between $50.00 and $300.00. You get the benefits of fractional shares and re-invested dividends (DRIP). All of it at no cost. All you have to do is let your money work for you!