Avoid costly RRSP mistakes. Pay attention as those mistakes can have a major impact on your retirement.

As you might have started with your tax returns, you might have also been thinking about whether or not you max out your RRSP contributions. If you haven’t contributed to your RRSP for the fiscal year yet, keep in mind that you have time till March 1 to do so.

If you contribute before the deadline, you’ll benefit from the tax deduction at the time of filing your taxes. There’s no doubt that RRSPs are one of the finest retirement-saving tools that offer vivid tax benefits.

But when improperly used, these mistakes can easily make your retired life miserable. To be on the safer side, you must know the RRSP mistakes that should be avoided from the very beginning. But before that, let us know some more details about RRSP.

What exactly is an RRSP?

A Registered retirement savings plan (RRSP) is a type of account specially meant for helping Canadians so that they can save for retirement. The money in an RRSP can be utilized to buy any sort of valuable investment like – mutual funds, ETFs, stocks, bonds, etc.

Contributing to an RRSP will reduce your taxable income in the year when you contributed the money. Apart from that, investments that are held in your RRSP will get a tax exemption on any interest, dividends, or capital gains you earn.

RRSPs are federally registered accounts which are subject to certain rules. One of the rules is that you have a limited amount of money to contribute to the account in any year. RRSP contributions are made with pre-tax dollars and the amount changes; the maximum contribution amount is 18% of your income or the maximum identified by the federal government, whichever is smaller. (The maximum is increased annually)

You may also increase the contribution if you didn’t max out your investments in earlier years. You can check out the Notice of Assessment that you’ll get after filing your taxes last year. If you have a pension plan (as a defined benefit plan or a defined contribution plan), the money will directly reduce the amount you’ll contribute to an individual RRSP.

If you happen to over-contribute, don’t panic! Here is a guide to resolve RRSP over-contribution.

12 RRSP Mistakes to avoid

#1 – Not having a plan

You need a financial plan from the very beginning and also need enough time to complete it. Your plan should be set up to stand against the time, the odds and the flows of the market.

#2 – Selecting a wrong plan

It is one of the biggest mistakes that you can make. Making choices based on the products you buy instead of considering your overall financial plan is wrong. This often happens when tax season comes and you are making last-minute decisions.

Do not get motivated by tax savings, think about your overall savings. Always choose a plan that may serve a balanced purpose, and diversify your investment portfolio.

#3 – Contributing too much

Contributing too much to your RRSP can create problems. Due to over contributions, you can be penalized by 1% per month on contributions that exceed your RRSP deduction limit by more than $2,000.

If this happens, you can rectify the over-contribution and avoid some penalty fees. See the guide to resolve RRSP over-contribution.

#4 – Missing a contribution

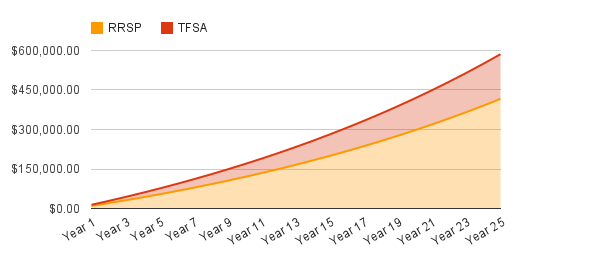

If you skip just one annual contribution of $5,000, it may reduce the value of your RRSP by almost $17,000 at the end of 25 years (using a 5% annual rate of return). So, do not forget to contribute every year to take advantage of RRSP.

Any amount will help. Just set it on autopilot.

#5 – Withdrawing early

One of the biggest mistakes that a Canadian can make is withdrawing funds from his/her RRSP before retirement. What will happen if you withdraw funds early? You’ll lose your contribution room and the tax-deferred growth.

This withdrawal will be considered under withholding tax of 10% to 30%, but you might also pay a higher marginal tax as your money withdrawn from RRSP will be added to your income for that year.

Be sure that it is your last option and consider the tax impact for the year you make the withdrawal.

#6 – Starting too late

Starting for RRSP is wrong, the earlier you start saving money for retirement, the better.

It might get difficult to start saving early for those in part-time, temporary jobs. It is best if you can start an RRSP contribution when you have a regular job with a predictable income. You don’t need a large amount to start, as little as $25 a month can be enough.

#7 – Not taking enough risk

Many Canadians avoid buying stocks in their RRSP just because they don’t want to lose money. It is right that you shouldn’t take too much risk with your RRSP, but you also shouldn’t avoid investment risk that you can’t even grow your RRSP.

You may go for safe investments like GICs and bonds, but you won’t have enough to retire peacefully. For a better chance, you will have to consider some risk and hold stocks in your RRSP to get higher returns.

#8 – Not understanding mutual fund fees

Canadians pay some of the highest fees in the world.

Over many years, fees towards your financial advisor can add up, further reducing your retirement plan. Make sure you ask for a detailed explanation of the fees, and how they may affect your retirement plan.

#9 – Don’t miss the deadline

While you want to contribute during the calendar year, the final date to contribute is often the end of February or the first of March depending on where it lands on the weekly calendar.

#10 – Don’t forget your spouse’s RRSP

Sometimes, there is a need to balance the spousal RRSP with yours for tax reasons. If it applies, make sure you leverage the spousal RRSP as a tool.

#11 – Spending your tax refund

Part or all of the tax deduction due to your RRSP contribution is going to be repaid in the future when you withdraw funds. So, it is best to re-invest your tax refund in your RRSP or TFSA. You should update Form TD1 and T1213 so that fewer taxes are deducted from your income and you do not have to wait until tax season to invest your tax refunds.

#12 – Using your RRSPs to manage debt

First of all, do not use money withdrawn from your RRSP fund. But if you still need the money, you may use it as a down payment on your first home. Never consider that money to pay off debt.

You may consolidate your debts by taking out a separate personal loan and paying them off. You may also manage your credit card debts by transferring balances into a 0% APR card. Do not put your retirement fund at stake.