Just when you think stability in the markets come around, world events happen and shift the pendulum. The reality is, there aren’t any stability ever. Stability can last 2 or 3 months but that’s just about it when it comes to world events and you should not focus on playing those events for a long term portfolio. Yes, there can be money to be made if you do short term trading but a long term dividend growth investing strategy will succeed regardless of those events.

As you read through, you will noticed detailed graphs built from all the data I track to monitor and manage my portfolio. Just like an airplane pilot needs its instruments to navigate in the air, I need my investment data to manage my portfolio. Don't manage your portfolio blindly hoping for results, you'll be sorry later.

Stock Trades

I purchased the following stock for our TFSA contributions this year:

- Intact Financials TSE:IFC

- S&P500 Index ETF (VFV)

Otherwise, I am sitting with some cash, ready to invest. Some are non-registered, and some are in my RRSP. I have not decided how to deploy it yet.

Portfolio Management

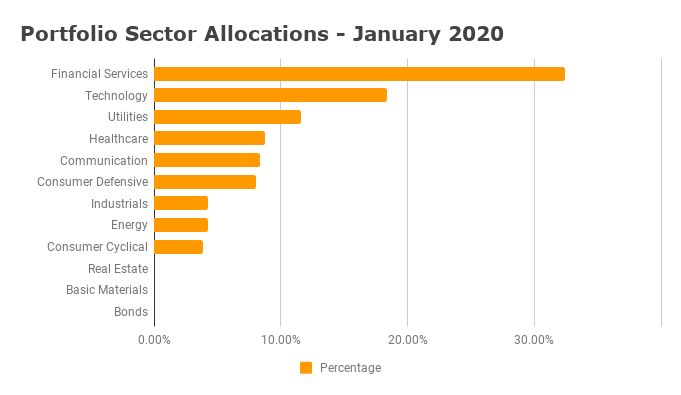

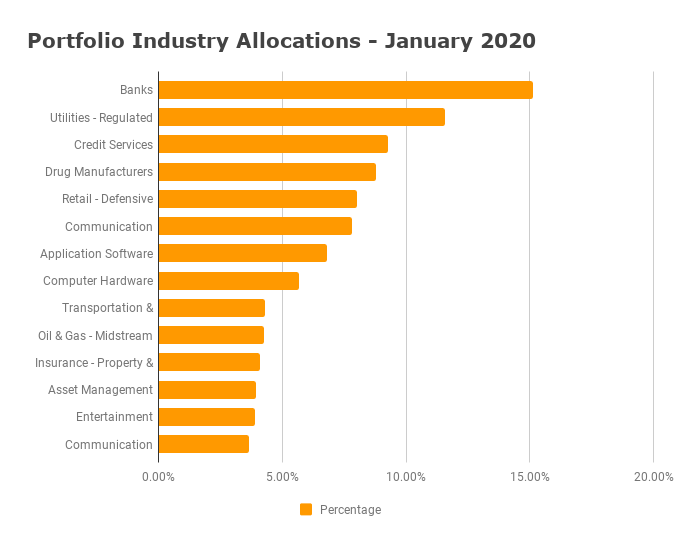

Visa NYSE:V, Mastercard NYSE:MA, Blackrock NYSE:BLK and Intact Financials TSE:IFC simply make my financial sector look so overweight but it’s not. That’s why I started reviewing by industry to break down my exposures as needed. With that said, my banking stocks are also now split between US and Canada with one of them very local to Quebec.

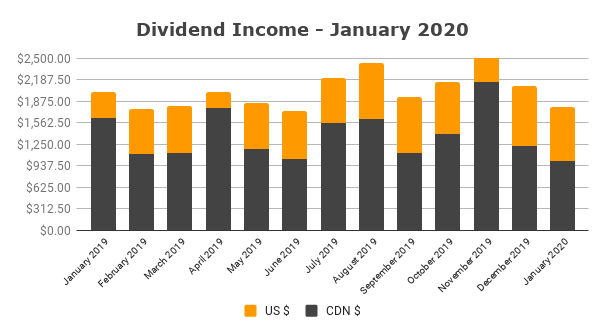

Dividend Income

My January 2020 dividend income is a low $1,788. My monthly dividend income is not balanced and that’s not a problem. Balancing monthly income should not be a goal as you should have a cash waterfall approach where the dividend income (if used for retirement) should fill next year’s income or the following year to be safe.

My approach leads to the following dividend income but there is more than one way to build a dividend income portfolio.

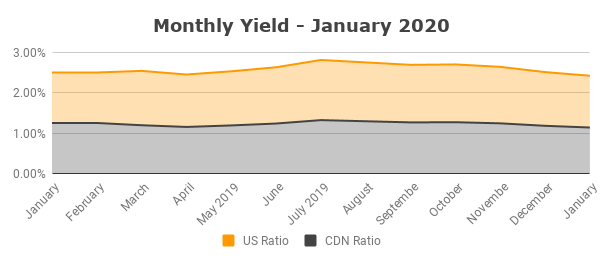

When it comes to investing and focusing on income, the yield tracking below shows what stock appreciation can do to a portfolio. While none of my investments have reduced their dividends, my yield goes down which means my stocks are appreciating. This is a result of focusing on dividend growth. I get to have dividend growth and stock appreciation. This is why my portfolio is growing so fast. Every single one of my holdings grows their dividends with the exception of the VFV ETF so think about it, to drop the yield, the value of the portfolio my grow at a faster pace.

This is the benefit of using the Chowder Score and focusing on a score of 10% and above which is the yield and the growth together as opposed to just focusing on yield.