A bit of a wild ride these past two weeks, wouldn’t you say? I think it’s going to be wild for a little while with all the trade discussions. While I would like to say it doesn’t impact companies, it unfortunately does. You do have to pay attention.

I suggest you review your holdings and do a portfolio stress test. There is no need to panic. You just want to be sure the fundamentals of your holdings have not changed dramatically. This is also a moment where you can decide if buying individual stocks is too much work versus buying Index or Dividend ETFs.

Stock Trades

I made one $5,000 contribution to my portfolio in May and I have some more money to invest but I am watching the markets for an opportunity.

- I added to National Bank and increased my position. I have a half position now.

- I eliminated my position in Illinois Tools Work and bought the cloud software index ETF called IGV. Really bad timing on this one but it’s a tiny position.

- I increased my position in Brookefield Infrastructure by taking some profit from TD Bank. That also increased my dividend intake.

- I eliminated my position in CIBC ahead of earnings (lucky) and increased my position in Royal Bank. It’s not quite a full position but it’s almost there. I now have 3 of the top 6 banks.

A full position for my portfolio is when the stock reaches 5% of my portfolio weight. If it goes above 6%, I will consider taking profits as I did with TD Bank.

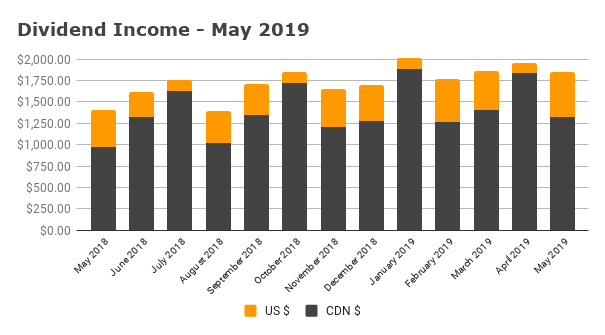

Dividend Income

My May 2019 dividend income is $1,848. My May dividend income is now 31% higher than last year for the same month. Dividend growth plays a key role and since I aim for Dividend Ambassadors when possible, otherwise the Chowder Score plays a big role. I expect good growth over time to come from my holdings.

You can see my holdings and I update the list monthly at least. As you can see, investing in individual stocks requires investors to pay attention. In general, you need to pay attention to your portfolio I would say regardless of the strategy a blend of ETF and individual stocks can also work. The Vanguard S&P 500 Index ETF (VFV) has become a go-to investment if the Canadian option doesn’t beat the S&P500. The yield is just around 2.00%.