The relationship between dividend growth and dividend income is an inverse relationship. Be aware of that when you invest. One way to look at it, is if you invest for income, you are looking at getting 6% return whereas if you invest for growth, you are looking at a 10% return. Return and income are not the same so be aware of what you are looking for. A 20-year-old, should not need to focus on income from REITs as an example.

Here is what I started doing to keep track of my dividend growth stocks vs my dividend income stocks. As you approach your retirement years where you want to live from the income, you shift your portfolio towards income but make sure your dividend growth is still above inflation since a flat income from a REIT will not keep up with inflation.

Stock Trades

In September, I did the following transactions:

- I added Enbridge to increase my position but I am not looking for a full position.

- I bought more Cisco to increase my position.

- I reduced my position in Telus. It’s mostly an income stock expending in other industries to grow and targeted for consumer price control. This trade really conflicts many investors because they see the telcos as the bedrock of their portfolio. I have held it for close to 10 years and the performance is not great just like the Canadian market in general. Those who invest in the US will understand.

- I have been slowly adding to Alimentation Couche-Tard with 3 small transactions in the month.

A full position for my portfolio is when the stock reaches 5% of my portfolio weight. If it goes above 5.5%, I will consider taking profits.

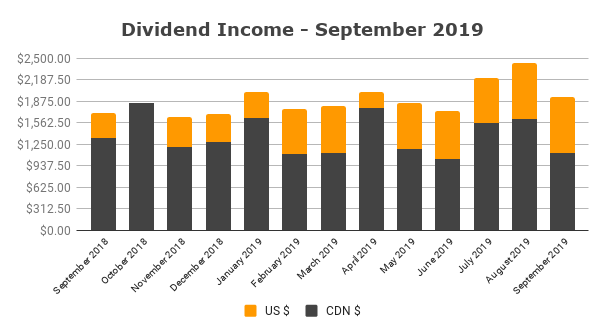

Dividend Income

My September 2019 dividend income is $1,938. My dividend income is starting to average $2,000 per month across all accounts as per forecasting for the last 3 months. Investments earlier in the year are now paying off with dividend increases.

I still heavily rely on the Chowder Score to filter my investments which allows me to receive generous dividend growth.

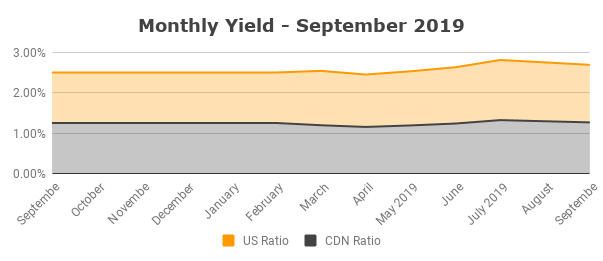

Below is the yield fluctuation based on the market value and the dividend payments. I am graphing it to see what it means to switch from dividend growth stocks to dividend income.