Over time, bonds should find a place in your portfolio. How much you should have will definitely depend on your investment strategy and appetite for market swings.

If you are in the market for bonds, you can get in on the initial offering or on the secondary market. It doesn’t matter if you have a lot of bonds or just a little bit, bonds are relatively easy to purchase.

Let’s be clear about one topic, bond ETFs are not fixed income investments, they are equities with a focus on fixed income just like a REIT ETF is an equity that focuses on real estate investments.

A bond is its own type of investment vehicle and it has properties that differ from an ETF or mutual fund. A fixed income investment is meant to provide you with just that; fixed income without a fluctuating value.

With a bond, you should not lose money. You technically get your money back at the end of the term or if it is called back plus the interest due. It’s basically a loan to the government, a province, a municipality or a corporation.

The risk is all relative which reflects the interest rate you would receive. Unlike an ETF or a mutual funds where the value of the equity is constantly changing based on market values.

How To Buy Bonds

On the secondary market, you need to know what you are looking for as you are going to purchase a very specific bond. The purchases usually start with a minimum of $5,000 with $1,000 increments. Verify with your discount broker before you make the purchase.

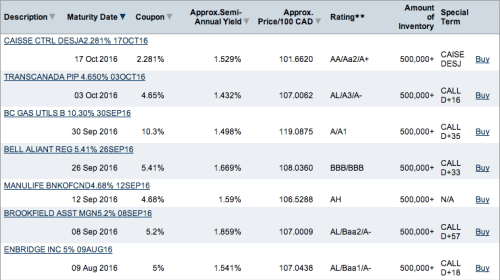

Screening Bonds With RBC

The screening I have been able to do with RBC Direct Investing covers the following criteria. The ‘Rating’ is an important one for safety. Obviously, anything above $100 has a premium and anything below is sold under value. The maturity date and the risk usually play a factor in the secondary market value.

- Description

- Maturity Date

- Coupon

- Approx. Semi-Annual Yield

- Approx. Price/100 CAD

- Rating

- Amount of Inventory

- Special Term

Also part of the filtering is the type of bond that you are looking for such as

- Government of Canada

- Provincial

- Municipal

- Corporate

- Strips

Once you start filtering, you will notice that the above list really highlight the type of risk you are willing to take along with the available yield. Often times, if you purchase bonds on your own, it’s much better to purchase when they are released than on the secondary market.

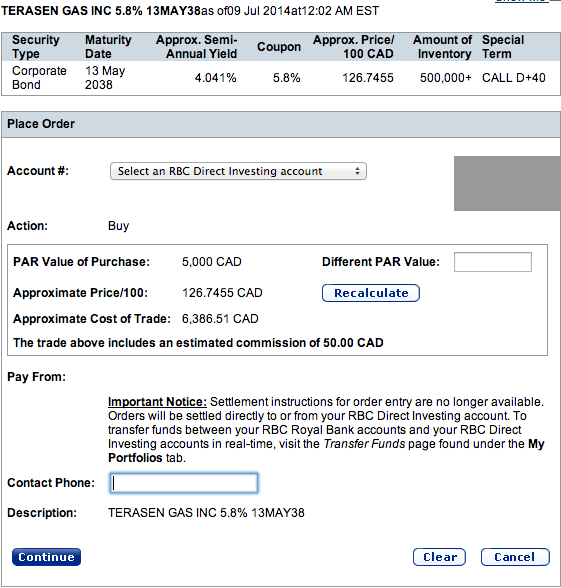

RBC Bonds Purchase

The actual purchase from my discount broker is pretty simple. Once you have selected the bond from the screening list, you just have to click buy and proceed through the steps.

In the case of this bond from Terasen Gas (a.k.a. Fortis), there is a premium to pay up front for the yield. It does expire in 24 years and you would get the $5,000 for the bond plus all the interest earned. Is it worth the premium? Some people might argue that they won’t be around and the yield is what matters now.